Senators Rick Scott (R-FL), John Cornyn (R-TX), and 42 of their Republican colleagues have introduced the Death Tax Repeal Act, a bill that would do away with the federal estate tax, commonly referred to as the "death tax." Senate Majority Leader John Thune (R-SD) has joined the large number of GOP senators in reintroducing this legislation as well.

The legislators want this bill to end the "surprise" tax on businesses, families, and farms and ranches when a loved one passes away. The Death Tax Repeal Act would also end the Generation-Skipping Transfer (GST) Tax, it would modify the Gift Tax for inflation, and treat transfers into trusts as taxable gifts.

This move from the Republican legislators comes after Representatives Sanford Bishop, Jr. (D-GA) and House Budget Chairman Jodey Arrington (R-TX) introduced a bipartisan bill, the Estate Tax Reduction Act to cut the estate tax rate in half.

The congressmen want to help American families retain their family businesses by reducing the penalties for "death taxes" and allowing for an easier transition of ownership, financially. This bipartisan solution wouldn't eliminate the death tax entirely but could be a more feasible way to get legislation of this sort across the finish line.

Sen. Scott shared that Americans who've sacrificed their time, talent, and treasure have helped the nation's economy and their children and/or businesses shouldn't be punished for it upon their death.

“Florida families who have dedicated their lives to starting small businesses, like farms and ranches, help put food on tables and fuel the state’s economy," said Sen. Scott. "The families who own these businesses are working hard to support their own livelihoods while building legacies for future generations."

Scott continued by saying, "We can’t let that effort be crippled by a sudden, overwhelming financial burden like the death tax. I’m proud to join my colleagues on this commonsense legislation to make sure family-owned businesses, farms and ranches can flourish for generations to come.”

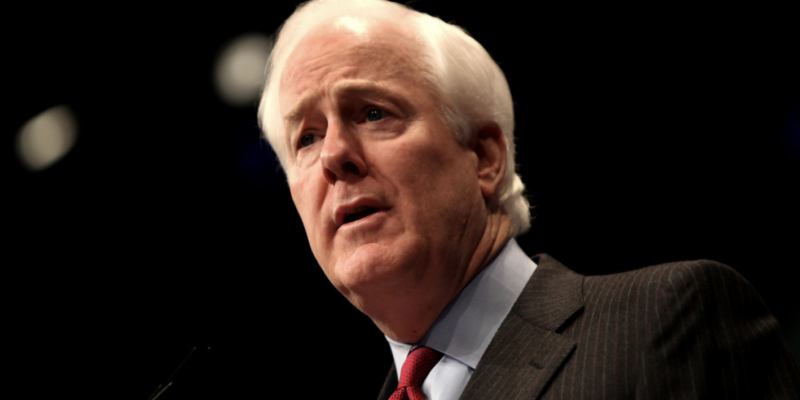

Moreover, Sen. Cornyn said that while families are grieving, they shouldn't be dealing with hardship such as the death tax.

“An added financial burden is the last thing families should have to deal with in the wake of a loved one’s passing,” said Sen. Cornyn. “By repealing the death tax, this legislation would alleviate unnecessary hardship and offer greater financial opportunities for Texas families, farmers, ranchers, and businesses.”

Furthermore, Leader Thune mentioned that every farm and ranch is "vital" to the economy and the culture of South Dakota, and a death tax is not worth losing any of them.

“Family farms and ranches play a vital role in our economy and are the lifeblood of rural communities in South Dakota. Losing even one of them to the death tax is one too many," said Leader Thune. It’s time to put an end to this punishing, burdensome tax once and for all so that family farms, ranches and small businesses can grow and thrive without costly estate planning or massive tax burdens that can threaten their viability.”