Hispanic business leaders warned this week that Texans could face much higher health insurance costs if Congress lets enhanced ACA tax credits expire this year.

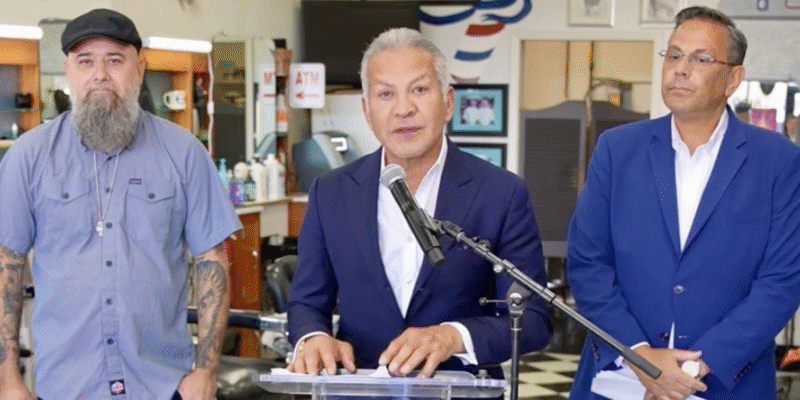

At Kervin’s Barber Shop in East Austin — one of the city’s oldest — leaders from the Hispanic Business Alliance, U.S. Hispanic Business Council, and Every Texan urged Congress to act before open enrollment starts on November 1. They said the move would help millions of working Texans, including small-business owners, keep their health coverage affordable.

“Congress must act before November 1,” said Julio Fuentes, president of the Hispanic Business Alliance. “Families are opening renewal letters right now showing premiums that are hundreds or thousands of dollars higher. Extending these tax credits is commonsense, bipartisan, and time-sensitive.”

Growing Bipartisan Interest in Texas

The issue has drawn attention on both sides of the aisle. While many Republicans have long criticized the ACA, several are now open to a short-term fix as inflation and insurance prices climb.

Rep. Monica De La Cruz (R-TX) co-sponsored bipartisan legislation to temporarily extend the enhanced ACA tax credits. She and other Republicans describe it as a “fiscally responsible bridge” for working families while Congress debates long-term health reforms.

Others in the Texas delegation, including Sen. John Cornyn, have said they’re open to talks about a limited extension to avoid steep premium spikes for Texans buying plans on the ACA Marketplace.

Texas Stakes: Small Business and the Economy

Nearly four million Texans enrolled in ACA Marketplace plans this year, most with help from these tax credits. If Congress does nothing, those credits will end at the close of 2025. Premiums could double or triple starting in January 2026.

That would hit independent workers the hardest — barbers, truck drivers, landscapers, and shop owners across the state. Economists say letting the tax credits expire could cost Texas billions in lost income and tax revenue.

“As a native Texan, I know the impact this will have,” said Javier Palomarez, president and CEO of the U.S. Hispanic Business Council. “Over a million Texans could lose coverage immediately when these credits expire. The state would lose $24 billion in taxes, and Texas would again lead the nation in the number of uninsured residents.”

“A Political No-Brainer”

Polls show that about 78 percent of Americans, including the majority of both Republicans and Democrats, support extending the enhanced tax credits. Fuentes said renewing them should not be a partisan issue. “This is a political no-brainer,” he said. “It protects working families, small businesses, and the economy. The Texas delegation should lead the way and get this done before open enrollment begins.”

Whether Congress acts in time is still unknown. But in Austin this week, the message was clear: for small businesses and working Texans, the clock is ticking.