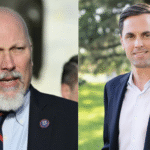

U.S. Representative Chip Roy (R) has introduced the No Tax-Exemptions for Terror Act, legislation designed to eliminate tax-exempt status for extremist groups that maintain close ties to terrorist organizations.

"It is absurd that the U.S. has provided organizations with ties to terrorism tax-exempt status in the U.S. - resulting in the American people inadvertently subsidizing terror against themselves," Roy said in a statement. "It is ridiculous, and we should have ended this long ago."

Roy argues that no organization with ties to terrorism should benefit from U.S. tax exemptions, citing the Council on American-Islamic Relations (CAIR).

"For example, the Council on American-Islamic Relations (CAIR) should immediately be stripped of its 501 (c)(3) status," he urged, citing that they have "ties with Hamas, the Muslim Brotherhood, and other extremist organizations that routinely use violence and commit horrific acts to advance their political agenda." "CAIR's national Executive Director even praised Hamas' barbaric October 7th attacks against Israel."

The legislation has several cosponsors, including Representatives Randy Fine (R-FL), Byron Donalds (R-FL), Clay Higgins (R-LA), Andy Ogles (R-TN), Keith Self (R-TX), Diana Harshbarger (R-TN), Mary Miller (R-IL), Andrew Clyde (R-GA), Andy Biggs (R-AZ), and Eric Burlison (R-MO).

If enacted, the No Tax-Exemptions for Terror Act would prohibit federal tax benefits for any organization linked to groups engaged in terrorism, reflecting a broader push to ensure U.S. tax policy does not indirectly support extremist activity.