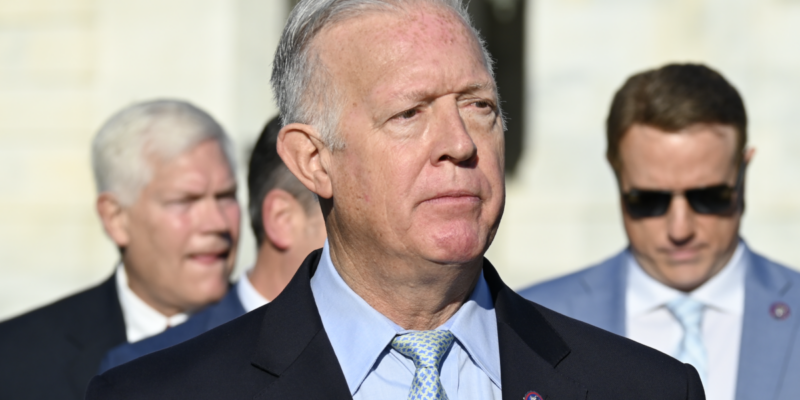

WASHINGTON—Former Missouri Rep. Billy Long (R) has been confirmed as the 51st Commissioner of the Internal Revenue Service (IRS), and Republicans Lawmakers are calling for major reform as "Deep State" holdouts continue to walk the halls of the government agency.

In an exclusive interview with Texas Politics, Rep. Randy Weber (R) suggested that Commissioner Long’s leadership could usher in a long-overdue age of transparency, efficiency, and accountability in the IRS.

During his Senate Finance Committee hearing before assuming office, Commissioner Long pledged to lead an IRS that “prioritizes customer service, identified critical technology infrastructure needs, and ensures greater transparency and audit practices.”

For critics of the IRS like Rep. Weber, Commissioner Long’s commitment signals a change to what they believe has been past overreach and secrecy from the agency.

Rep. Weber joked that Commissioner Long is “a crusty old guy,” noting that “he’s sharp as a tack, so I have confidence in him.”

He went on to add that the real challenge lies deeper within the IRS’s bureaucracy, commenting, “there are bureaucrats that have been there for way too long, and that’s part of the problem. Trump knew that. That’s why he was cuttin’ stuff. DOGE knew that. That’s why they were cuttin’ stuff.”

Longtime critics point to the Revenue Ruling 2024-14, which is a controversial regulation that was issued by the IRS’s Pass-Through Entity Compliance Unit. The rule allows audits of legal business transactions like basis-shifting under vague standards. The ruling has been a point of contention because critics argue that it redefines tax law without congressional approval, threatening businesses of all sizes.

Holly Paz, who has been called a “deep state” bureaucrat by critics, is one of many agents who Rep. Weber believes the Trump Administration should let go of.

Despite the political hurdles, conservatives remain positive of the IRS’s future under the leadership of Commissioner Long.

“It’s time for a change,” Rep. Weber affirmed.

Should President Trump rescind the IRS's vague Revenue Ruling 2024-14, which is giving IRS bureaucrats the ability to pick winners and losers, and costing American businesses billions in administrative burden?

"A federal agency has no business in targeting any group of people unless they pose a national security threat. The government always gets into trouble when they get in the business of picking winners and losers," said Florida Congressman Carlos Gimenez when asked if President Trump should rescind the IRS' vague Revenue Rulling 2024-14. "Unelected bureaucrats need to concentrate on doing their jobs in the most non political and non partisan manner possible."

The ruling gives IRS bureaucrats the ability to pick winners and losers, and costs American businesses billions in administrative burdens.