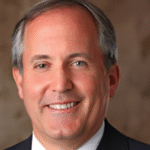

Texas Attorney General Ken Paxton is touting a legal victory in his high-profile lawsuit against asset management giants BlackRock, Vanguard, and State Street. He is accusing them of conspiring to suppress coal production under the guise of ESG (Environmental, Social, and Governance) goals. But recently disclosed financial records reveal a stark contradiction, Paxton holds between $1.6 million and $6.25 million in Vanguard mutual funds.

The lawsuit, filed after the 2024 presidential election and backed by ten other Republican-led states, claims these firms colluded to drive up energy costs by restricting coal output. Paxton argues they used their combined shareholder power to impose environmental restrictions on companies they partially owned, effectively pressuring them to shrink operations in favor of "green energy" priorities.

Yet while railing against this alleged "investment cartel," Paxton's largest personal investment is in Vanguard’s Institutional Index Fund, worth between $1 million and $5 million. His financial disclosure also lists additional shares in actively managed Vanguard funds, as well as investments held by his wife, State Senator Angela Paxton, who filed for divorce in July.

Critics, including allies of incumbent Senator John Cornyn, whom Paxton is challenging in a heated GOP primary, say the attorney general’s investments directly undercut his public crusade.

“If he truly believes this firm is hurting Texans, why is he investing his personal money with them?” asked Aaron Whitehead of Texans for a Conservative Majority.

But the contradiction goes further. One of Paxton’s proposed remedies is to force the defendants to divest from coal companies. A move that could strip the industry of nearly $18 billion in capital.

Despite backing from the FTC and DOJ, experts warn the suit could accelerate coal’s decline, hurt miners and undermining President Trump’s pledge to revive the American coal industry.

While Paxton casts himself as a defender of energy independence, his investments in one of the very firms he vilifies raise serious questions about the sincerity, and potential consequences, of his campaign against ESG investing.