The Senate has officially voted against the Biden Administration’s student loan forgiveness plan.

The bill passed with a slim margin of 52-46. The majority of Democrats voted against overturning the bill. Texas Senators Ted Cruz (R) and John Cornyn (R) voted to overturn the student loan forgiveness plan. However, 2 Democrats and 1 Independent also voted with Republicans to overturn the bill.

Approximately 43.5 million Americans have student loan debt. Furthermore, the average amount of student loan debt is $37,338, which is over half the American salary.

Despite the vote, President Joe Biden (D) is expected to veto the measure. The plan is currently being held in the Supreme Court as Americans across the country await their decision.

There have been several bipartisan measures introduced and passed this year. However, in some cases, there are still disagreements across party lines.

Many of the disputes have been financially focused. Foreign spending, the allocation of COVID funds, student loan payments, and more, have been big sticking points for the two parties.

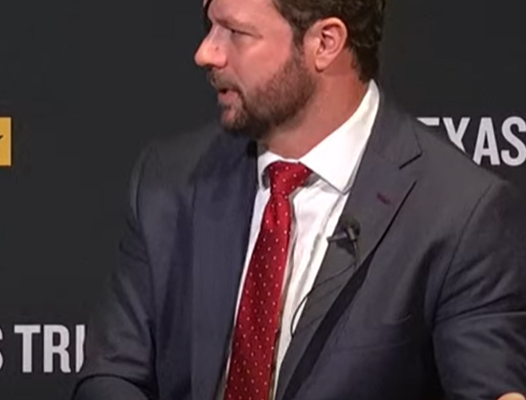

Texas Representative Dan Crenshaw (R) recently attacked various Democratic policies regarding drug prices and the economy.

“.@ScottGottliebMD is right. Democrats’ price controls are hurting the generic drug pipeline and intensifying drug shortages that endanger patient care and threaten our national security,” said Rep. Crenshaw.

Rep. Crenshaw criticized the Democrat’s policies as being shallow and insubstantial.

“The price of a drug won’t matter if it no longer exists because no one can afford to make it. Be careful when advocating for superficial solutions that seem nice at first glance but have very problematic unintended consequences.”

In other news, Texas Representative Pete Sessions (R) questioned Vice Chair of the Federal Reserve Michael Barr on what he perceived to be a lack of responsibility from the Federal Reserve.

“.@FinancialCmte warned about the effects of trillions in new spending and full-speed quantitative easing,” stated Rep. Sessions.

The Texas lawmaker continued by criticizing “aggressive supervision” and the current administration’s actions.

“The correct answer isn’t aggressive bank supervision — this Admin and its sluggish financial regulators must take responsibility for their reckless policy and spending.”

After being questioned by Sessions, Michael Barr responded with an explanation of what happened.

“I joined the Federal Reserve Board in July 2022, at a time when the Federal Reserve was clearly raising interest rates and had been raising interest rates for some time. My understanding…is that it was quite clear from the fall of 2021 that interest rates were gonna go up. The bank decided to…remove interest rates’ hedges that protected it in a rising interest rate environment. So, I think the findings are clear on that point,” explained Barr.

Sessions still remained doubtful and was insistent on someone taking responsibility for the failures of the Federal Reserve.

“Well, I remain skeptical, and I know that I’ve heard the testimony today…

everything is OK. We’ve gone back and double-looked at everything. Nothing bad is going to happen. It’s all taken care of. My point would be, I think somebody needs to accept the blame. I fail to see that the advice given from the very top was, in fact, incorrect. Some of the down management decision making, including boards, was they…made decisions based on the top of the deck.”

“So, I’m not crying over spilled milk. There should’ve been some history to understand if you raise spending $3 trillion, and then do what has happened out of treasury you’re going to have a problem.”